how are qualified annuities taxed

Generally annuities in qualified or non-qualified accounts are taxed differently. There are however two main taxation categories.

How Are Qualified Annuities Taxed Youtube

When you make withdrawals.

. However the money in a qualified Roth annuity has already been taxed ie they are after-tax dollars. When you inherit an annuity the tax rules are similar to everything described above. The spousal continuation provision is a tax strategy you use to avoid paying taxes now.

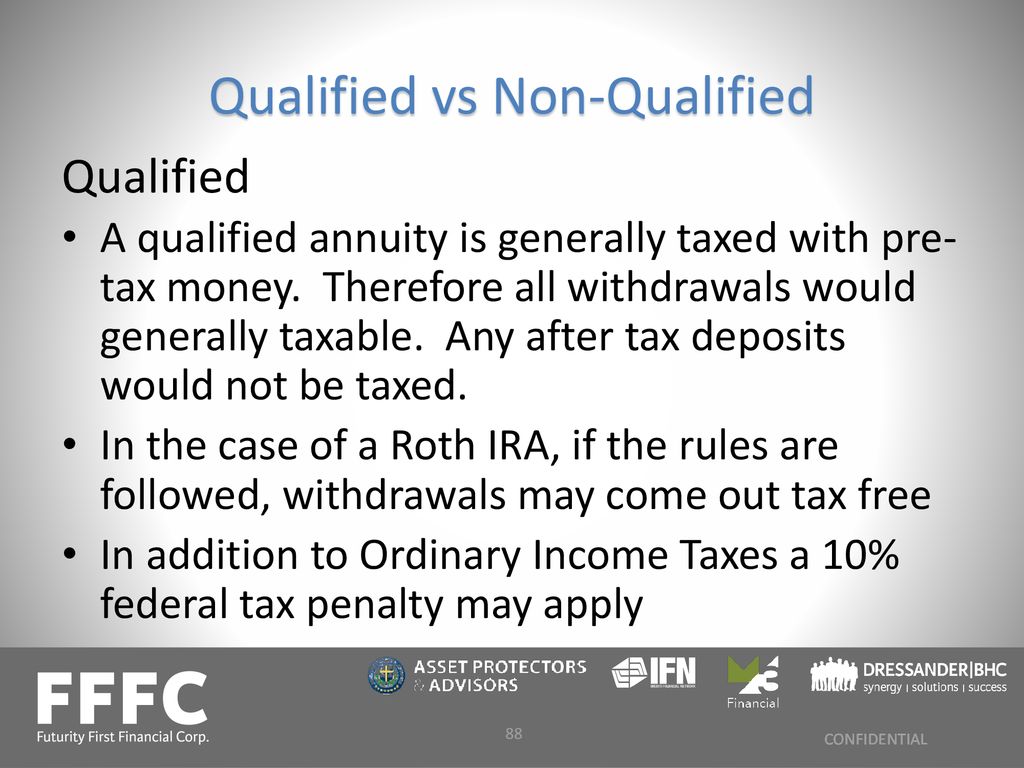

A qualified annuity is an annuity that meets the requirements of Internal Revenue Code section 401a and is therefore eligible for certain tax benefits. A Roth annuity can be part of a Roth 401k or Roth IRA. You fund a qualified annuity with pre-tax money money you have yet to pay taxes on.

Variable annuities - make payments to an annuitant varying in amount. If Matthew does not wind up using pre-tax retirement savings to buy the annuity itll be classified as non. A Roth annuity can be part of a Roth 401k or Roth IRA.

Funds for a qualified annuity typically come directly from a 401k a. Qualified annuities are usually funds from an IRA or a 401 k. In this case the tax rules governing.

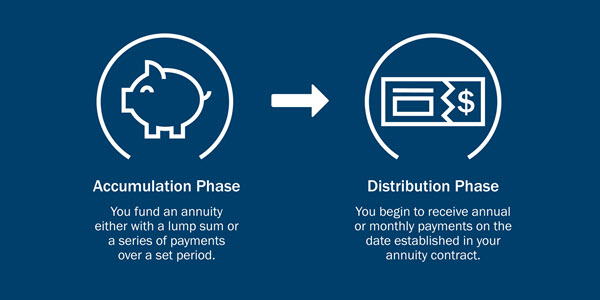

Qualified Annuity Taxation. Annuities are tax-advantaged insurance contracts in which you can save for retirement and from which you can receive a stream of guaranteed income. Qualified annuity distributions are fully taxable.

How Qualified Annuities Are Taxed. There are no contribution limits and income payments from the principal. However the money in a qualified Roth annuity has already been taxed ie they are after-tax dollars.

Two types of annuities exist. A non-qualified annuity is funded with money thats already been taxed. 2 days agoAnnuity taxation depends on the type.

A qualified annuity is distinguished from a non-qualified annuity which is funded by post-tax dollars. Understanding which one you have will make a big difference come tax time. What Is A Qualified Annuity.

An annuity bought with pre-tax dollars is considered a qualified annuity. As long as its. In general annuities are taxed differently if they are in a qualified or non-qualified account.

Lump-sum distributions withdrawals from. Fixed period annuities - pay a fixed amount to an annuitant at regular intervals for a definite length of time. You could also spread your tax payments over time by opting for non-qualified stretch payments based.

A non-qualified annuity is an annuity bought with after-tax dollars whereas a qualified annuity is an annuity bought with pretax dollars in most cases. That confers certain advantages. A qualified annuity is one purchased with pre-tax dollars.

Qualified annuities are those purchased through a qualified plan like a 401k or SIMPLE IRA and are normally paid for with pre-tax dollars. Here are the differences for tax purposes. Nonqualified variable annuities dont entitle you to a tax deduction for your contributions but your investment will grow tax-deferred.

To see how this works lets analyze Matthews immediate annuity.

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

The Basic Principles Of Annuities Ameriprise Financial

Annuity Taxation Fisher Investments

Variable Annuities Taxes Match With A Local Agent Trusted Choice

Annuity Tax Forms For Qualified And Non Qualified Income Annuities

Annuity Taxation How Various Annuities Are Taxed

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Inherited Annuity Tax Guide For Beneficiaries

How To Buy An Annuity Morningstar

Understanding Annuities Ppt Download

What Is A Tax Deferred Annuity Due

Annuity Non Qualified What S Is This The Annuity Expert 2022

The Impact Of The Secure Act On Qualified And Non Qualified Annuities New Jersey Law Journal

Annuity Taxation How Are Annuities Taxed

Annuity Vs Mutual Funds Which Is Right For You 2022

What Is The Best Thing To Do With An Inherited Annuity Due

Annuity Loans Simplified Guide Match With Agents Trusted Choice